10 Easy Ways to Invest For Your Future

10 Easy Ways to Invest For Your Future

Yes, there are easy ways to invest—we promise! Don’t believe us? Keep reading.

One major hurdle to investing is consumerism. There are so many other cooler things to buy—the latest smartphone, that designer pillow found on Pinterest, those hand-made mittens by the Nepalese artisan on Etsy—and we can have them now.

Our society is built on immediate gratification. Anything we want is a swipe, scroll, and click-and-pay away.

Investing versus online shopping

Unfortunately, investing hasn’t developed the same familiarity and reputation of ease as shopping. If it had, we’d be investing as much as we shop online.

We’re here to tell you that buying an investment can be as simple, easy, and satisfying as buying the latest tech.

In this article, we’ve put together a list of 10 easy ways to invest for your future. The best part: you can start to do them today.

Before we divulge our list, let’s begin with a quick look at the reasons why people don’t invest.

Reasons People Wait To Invest

If you’ve ever given an excuse for why you don’t invest, don’t worry—you’re not alone.

The following are four common reasons people don’t save money.

Reason #1: They don’t have enough money

Whether because they have too much debt or too low a salary, an apparent lack of money can be a reason people put off investing.

Take Canadians for example. Almost a third (31%) believe they have too much debt (Statistics Canada, 2019). A high debt load can prevent us from saving for the future because we think we should pay down the debt before investing.

The truth is the faster you start investing, the more time you’ll have to weather the ups and downs of the stock market, and the more you’ll benefit from compound interest—even if you have debt.

Compound interest calculator

To give you an idea of the impact of compounding, we encourage you to use the compound interest calculator on our website.

Even if you don’t have anything saved at the moment, or aren’t sure how much you can afford to save every month, you can play by plugging in arbitrary numbers in the calculator to give you an idea of how money can grow over a period of time.

Tip: We recommend using a conservative interest rate of 6%.

How investing is like starting a family

Investing is like having children: it never seems like the right time. The longer you wait to start, however, the more you risk it never happening.

Which brings us to reason #2:

Reason #2: They’re waiting for the right time

The stock market goes up and down more often than a merry-go-round.

People often wait for a drop in the market before they take the plunge to invest. Or, they may decide that this type of volatility, with dramatic lows that can happen on a single day, is too much excitement for them.

The good news is that, like a merry-go-round, after markets go down they always come back up.

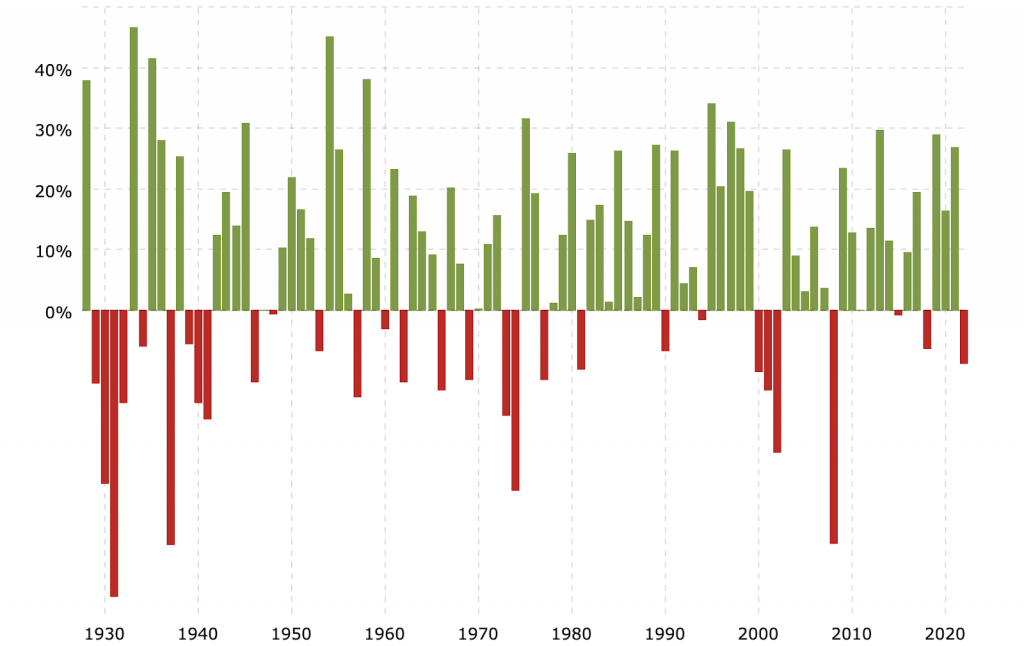

The Gold Standard: S&P 500

The S&P 500—short for the Standard & Poor’s 500 Index—is a marker of how well the 500 top publicly traded companies in the United States are doing.

If the S&P is high, companies like Apple, Google, and Amazon are collectively said to be doing well. If it’s plummeting, something must be wrong with their latest valuation or iPhone roll-out.

S&P 500 Historical Annual Returns

Consider this: If we look at the time period between 1957, when the S&P got its name, to now, it has offered investors an annual rate of return of 10.67%—hugely better than the average savings account in Canada whose best rates are between (a barely there) 0.05% and 1.55%.

In the past year, from February 2021 to January 2022, the S&P has grown 15.35%.

The S&P’s 2022 year-to-date performance? A discouraging -9.22%.

And so goes the merry-go-round.

How to navigate stock market fluctuations

Yes, you should expect several financial crashes in your lifetime. Ignore the doomsday reports, stay focused on the long-term, and you’ll ride them out.

When you ten to stall and not invest, this could be a sign that you’re afraid. Which brings us to the third reason why people don’t save:

Reason #3: They’re scared

The stock market can seem like a daunting place to a beginner investor. People shy away from putting money in the market because they don’t understand investing, they think it’s too risky, or they’re intimidated.

When done poorly, investing is like gambling. When done well (by staying away from trends and gimmicks) investing is a very simple, safe, and easy way to build wealth.

How to educate yourself on investing

Instead of being crippled by the fear of investing, we recommend upping your knowledge by:

- Reading books on investing (many are available for free from your local library),

- Listening to financial podcasts,

- Reading money-related blogs and posts (like this one),

- Speaking with a reputable financial expert, and

- Experiment by investing a small amount of money

The best way to learn is to act. Once you start investing, you’ll find that the stock market isn’t the scary world you thought it to be.

Yes, learning about investing can take time. We’re here to help there, too. Keep reading for the fourth reason people give for not saving money.

Reason #4: They don’t have enough time

Our lives are busy and our time is limited. It’s no surprise that investing gets put on the backburner.

In this age of technology, online banking and brokerages, and financial management apps, it’s never been easier and faster to invest. We’ll talk more about this later in the article.

The key takeaway here is: procrastination is detrimental to investing.

The longer you wait to save, the more you’ll miss out on the benefits of compounding.

Why You Should Invest For The Future

Still resistant to the idea of saving money? Maybe that’s because you don’t have a big enough reason for why you should do it.

Invest to protect your future self

When you save money, you’re protecting your future self. What better reason could there be to squirrel away cash?

Here’s what investing allows you to do:

- Build a financial safety net for you and your family

- Project your income

- Make passive income

- Empower yourself to become financially self-reliant

- Prepare yourself for unexpected life events like an illness or injury

- Save on taxes (by investing in a TFSA and RRSP)

- Plan for an easier retirement

- Gain financial freedom

You now have several reasons for why you should start a rainy day fund. Here is our Top 10 list of easy ways to start that fund today.

10 Easy Ways To Start Investing Today

1. Decide How Much To Invest

Set a financial goal, then work backwards.

For example: If your goal is to have $1 million by the age of 70 and you’re 40 now, assuming a 6% average rate of return, you’d need to invest $1,000/month every month between now and then.

Save as a percentage of your income

If you have the room in the budget, go one step further and aim to invest between 10-15% of your income every month.

There are no minimums to investing. You can start saving with as little as $5/month.

If the goal you set seems unrealistic right, now remember you can work up to it. Like a marathon, put one step in front of the other, and one dollar in the bank at a time, and gradually you’ll reach your distance goal.

2. Open a brokerage account

A brokerage account is a type of fancy savings account. The difference is you put money in a brokerage account to buy securities like ETFs, index funds, stocks, bonds, and mutual funds.

The easiest way to set up a brokerage account is by hiring a brokerage firm. They’ll walk you through the various account options, figure out your risk tolerance (more on this later) with you, and discuss which types of investments are best to house in a brokerage account.

3. Learn About Your Investment Options

The number of investment options can appear endless:

- Mutual funds

- Stocks

- Bonds

- Exchange-traded funds (ETFs)

- Index funds

- Commodities,

- REITs,

- Real estate,

- Registered versus non-registered accounts

- Tax savings options

What does it all mean?

Take the time—a little bit of time—to learn about the various investment options available to you, their pros and cons, their associated risks, and which are the best options for you.

4. Automate Your Savings

The easiest way to reach a financial milestone is to automate savings. Here’s how:

- Deduct non-negotiable costs from your paycheck every month (mortgage/rent, utilities, insurance, groceries, etc.),

- Include your savings amount with these non-negotiables,

- What’s left over is what you have to live on.

Too many of us do it the other way around. What happens when we aim to save last? There’s never any money left over to do it.

5. Be Consistent

When you make saving automatic, leave it that way. Avoid the temptation to change the amount you set aside month to month.

- Invest at regular intervals; save money every time you get paid.

- Some employers will even do this for you; it’s worth asking yours.

- Be flexible. If after a couple of months you notice you were overly ambitious with your savings, readjust it.

Play the long game

Keep in mind you’re in it for the long-term. The less you mess with your investing, the easier and less daunting it will become.

With consistency, patience, and the right investments, you’ll find yourself with a comfy nest egg when it comes time to retire.

Drip by drip, dollar by dollar, you’ll reach your financial goals.

6. Respect Your Money

What do we mean by ‘respect your money’? We mean don’t waste it!

- Know where your money goes

- Spend it wisely and in ways that will align with your goals

- Don’t overuse credit cards, but know that credit is a useful tool we have at our disposal in an emergency

- Give less of your money to large multinational companies—and keep more for yourself

- Remember the difference between wants and needs

- Grow an emergency fund

As Donna Summers sang, (you) work hard for your money—so treat and use it well.

7. Know Your Risk Tolerance

Before you decide on how and where to invest, it’s best to know your risk tolerance.

- How much money are you willing to lose?

- How much can you afford to lose?

If you can burn thousands of dollars in cash without batting an eye, your risk tolerance is high. If you need liquid cash in case you can’t make next month’s rent, your risk tolerance is low.

Generally speaking, the younger you are, the riskier you can be with your money. If things go wrong and you lose your savings, you still have time to earn it back. The reverse tends to be true if you’re older.

6. Consider Your Financial Style

Ask yourself:

- Are you a hands-off investor or do you want to stay involved?

- Do you plan to check your accounts and portfolio every day (which we don’t recommend) or will you review it once a year?

- Are you the type to avoid looking at your bank accounts, and your bill statements, or do you stay hyper aware of every dollar going out the door?

When you understand your financial style you’ll be better able to decide what type of investment strategy to take and what you need to grow your net worth.

Don’t buy stocks that ask you to keep tabs on them like a day trader if what you’d rather do is work with a professional financial planner and be hands-off.

8. Pick An Investment Strategy

A purchase of a money plant is not an investment strategy.

- How are you going to invest your money?

- What is your philosophy around buying investments?

- What strategies will you use to keep you focused on your financial end game?

This point goes hand-in-hand with knowing your money style. Some strategies require a passive approach and others an active approach.

Examples of investment strategies

- Dollar-cost averaging (DCA), the practice of making consistent (!) investments over time

- Buy-and-hold investing is when you find an investment with high growth potential, buy a large amount of it at once, and then not sell it for decades

- Active investing is when you trade more frequently and opportunistically in an attempt to beat the market. You try to buy stocks low and sell them high on an ongoing basis.

For beginner investors who don’t want to spend every waking hour managing their portfolio, and for those who are low to medium risk takers, we recommend dollar-cost averaging.

9. Use Tech

Technology makes everything easier, including investing.

Download the right financial apps to your smart phone and use them to consistently save, watch the markets, and grow your financial education.

Our favourite money apps are:

- You Need a Budget (YNAB) – the best money managing and budgeting app with a free trial and affordable annual fee

- Mint – best overall FREE budgeting and finance app

- Yahoo Finance – a must-have app for watching the markets and reading financial news

And last but not least, the 10th easy way to start investing today:

10. Begin right now!

It’s never too late, or too early, to start investing.

Whatever the reasons you’ve given in the past for not saving, we’re here to tell you (again) that you can overcome them.

Stop procrastinating, start thinking about your future, and invest. With any luck, you’ll have fun at the same time.

Easy Ways to Invest With Your Employer’s Help

A discussion about investing wouldn’t be complete without talking about pension plans.

A pension plan is a registered plan that provides you with income after you retire. An employer pension plan is a specific type of pension plan. If your employer offers group retirement as part of your benefits, then normally you and your employer (or sometimes only your employer) would regularly contribute money to the plan.

In some cases, it’s a matching scenario; you opt in to contribute a percentage of your salary to the plan every month and your employer matches it, up to a certain amount—it’s like receiving free money towards your retirement savings!

Ask your employer whether or not they offer a group retirement benefit plan. You may not have realized they did and thus could be missing out on extra funds for your later years.

c

The bottom line: it’s easy and fast to start investing.

If you’re ready to start investing for the future, give us a call. Our Certified Financial Planners will be happy to review your current financial situation.

Together, we’ll discuss your needs and goals, figure out your risk tolerance, craft an investment strategy, and make a plan for your financial future.

Start investing today—your future self will thank you for it. Contact BP Group Solutions.