Turn Tax Season Into Your Favourite Season: The Ultimate Guide To Tax Filing in 2022

Turn Tax Season Into Your Favourite Season: The Ultimate Guide To Tax Filing in 2022

In honour of our favourite time of year—tax season!—we’ve put together the ultimate guide to tax filing in 2022.

In the guide, we’ll cover tips on how to better prepare your income tax return for the Canada Revenue Agency (CRA), talk about what self-employed and small business owners need to know about tax season, give you advice so you’ll feel less intimidated of tax season, and go over how a Certified Financial Planner, accountant, and bookkeeper can help make filing your taxes less anxiety-provoking.

To ease the stress, we begin with important tax filing dates to remember.

Important tax filing dates to remember

The key dates to remember when it comes to filing for 2021 taxes in Canada begin in March every year and run until mid-June.

RRSP contribution deadline

The first important tax date is March 1, the annual RRSP contribution deadline.

The RRSP deadline is the same every year unless it falls on a weekend. In that case, it gets pushed to the following Monday. Mark down March 1 on your calendar do you never forget it.

Even though the 2022 contribution deadline has passed, it’s never too late to start thinking about starting or growing an RRSP. In fact, it’s the perfect time of year to run the numbers and design a game plan to prepare early for the 2023 deadline.

A professional financial planner will look at your income and deductions and take your most recent T4s to simulate options for 2022 RRSP contributions to ensure the best tax refund possible in 2023.

The deadline to file your taxes in Canada

The second big date to remember is April 30, the tax filing deadline for most Canadians.

This year, because April 30 falls on a Saturday, we get an extra couple of days to submit our tax returns. The tax filing deadline in 2022 is therefore Monday, May 2, 2022.

Your tax return will be considered filed on time if:

- It’s received by CRA on or before May 2, 2022, or

- It’s postmarked on or before May 2, 2022

Don’t leave filing your taxes until the last minute, though. The CRA charges late-filing penalties if you owe taxes and submit your return late. The penalty is 5% of the balance owed, plus an additional 1% for each full month you file after the due date.

Speaking of which, the next date we’ll mention is an important one for those who owe income tax.

The deadline to pay your taxes in Canada

April 30 is an especially important date for another reason. Not only is it the tax filing deadline but it’s also the tax payment deadline. This includes the payment due date for income taxes, contributions, instalment payments, and any other amounts owed.

Like the filing deadline, since April 30 falls on a Saturday this year, you have until Monday, May 2, 2022, to pay the balance owing on your taxes.

If you walk into a bank on May 2 and they process your payment then, or you pay via online banking, your taxes will be considered paid on time.

If you can’t pay your taxes in full by May 2, 2022, you can work out a payment plan with CRA. To avoid interest charges for late payment, contact the CRA well in advance of May 2, 2022, to discuss your options.

An important tax date for the self-employed

If you or your spouse or common-law partner are self-employed, the date you want to keep in mind is June 15, 2022—this is the deadline to file your taxes.

Unfortunately, this doesn’t give you extra time to pay taxes owed. You still have to send in what you owe by the April 30 deadline, just like everyone else.

The good news is that being self-employed means you can take advantage of more write-offs than those who are not.

Go to the CRA website to view a comprehensive list of eligible deductions—and then work with a professional to ensure you are claiming your deductions properly to avoid later penalties and to benefit your business.

Plan ahead for tax season

Canadians procrastinate when it comes to filing their taxes. There are huge advantages of completing your tax return early, however, not least of which is less stress and better sleep.

We mentioned earlier that one benefit to early filing is the avoidance of paying late-filing penalties and interest charges. Here are some of the other reasons to file early:

- You have time to enlist the help of a professional, especially important if you have business deductions, investment capital gains, and tax saving contributions,

- You’ll often pay less for accounting services if you approach them earlier

- You’ll get your notice of assessment (NOA) and tax refund, if you’re entitled to one, faster,

- You have more time to save money to pay your taxes if you owe,

- You’ll avoid interruptions to government benefits like EI, the Canada Child Benefit, and GST credits.

Ways to file your tax return faster

The CRA processes tax returns in the order they receive them. An online submission will always arrive in their hands faster (read: instantly) compared to a return sent via snail mail.

This is especially true in today’s world of COVID-19 delays and benefits, which we’ll cover next. According to the CRA, it can take upwards of 8 weeks to process a physical return. The time to process an online return? 14 days.

How can you file your tax return faster? You can do so in three easy steps:

- Sign up for My Account and, if you own a business, sign up for a My Business Account,

- Sign up for Netfile, the CRA’s online filing system, and

- Sign up for direct deposit through My Account.

How COVID-19 benefits will affect your tax return

Do you need to claim COVID-19 benefits on your 2021 income tax return? The short answer is: yes.

If you received the Canada Recovery Benefit (CRB), the Canada Recovery Caregiving Benefit (CRCB), the Canada Recovery Sickness Benefit (CRSB), the Canada Worker Lockdown Benefit (CWLB), the Canada Emergency Student Benefit (CESB), or the Canada Emergency Response Benefit (CERB) before December 31, 2021, you’ll need to claim these as taxable income on your upcoming income tax return.

The long answer is depending on which benefits you received, you may or may not receive a T4A or T4B slip from the CRA outlining the amount you received. This is dependent on the type of benefit.

Regardless of whether you receive a slip or not, you still need to claim the benefit as income.

Which other COVID-related benefits can you claim?

The CRA has extended it’s temporary work-from-home tax break to support those who couldn’t go to the office due to COVID-19.

This simple flat-rate benefit allows employees to deduct a certain amount for each day they worked from home in 2021 up to a maximum of $500. To qualify, you had to have worked remotely more than 50% of the time for at least 4 weeks.

Traditional detailed employee benefit

The flat-rate option doesn’t replace the traditional detailed version of the benefit. If you worked from home in 2021, you can ask your employer to fill out a T2200 or T2200s form to claim work expenses on your tax return. This amount depends on the size of your workspace, among other things.

Keep in mind that if you go the detailed route, you’ll need documentation to support your claim.

Not sure which option to choose? Use the CRA’s calculator to determine which option is best for you.

COVID-19 interest relief

One final pandemic-related benefit it’s important to mention is interest relief.

If you owed taxes in 2020, received a COVID-19 benefit in 2020, and meet the eligibility requirements, you will not be charged interest on taxes owed until after April 30, 2022.

For more information on pandemic interest relief, visit the CRA website.

Repaying COVID-19 payments

Did you know that if you received a pandemic support payment before January 1, 2023, you have a choice on when you can deduct it? Here are the options:

- The year you received the benefit,

- The year you repaid the benefit, or

- A split between the two years (as long as the total deduction amount does not exceed the total support payment amount).

For more information on COVIS-19 support benefit repayments, visit the CRA website.

Other tax credits to consider for 2021 tax returns

There are hundreds of tax credits you can claim on your 2021 tax return. Aside from the COVID-19 benefits we’ve already mentioned, here are ten more to make note of:

- GST/HST Credit: All you have to do to receive this credit is file your taxes on time—easy! The GST/HST credit is an example of a refundable tax credit, or a credit where the government will refund you the money.

- Charitable Tax Credit: Give to a charitable organisation at some point during the year and then deduct this amount from your taxable income. This type of credit is an example of a non-refundable tax credit.

- Eligible Educator School Supply Credit: Teachers can claim the cost of school supplies up to a maximum of $1,000 every year. This gives eligible educators a 15% refundable tax credit.

- Canadian Child Benefit (CCB): The CCB is a tax-free monthly payment given to parents of children under the age of 18.

- Medical expenses: Canadians can claim certain medical expenses, e.g., dental fees and private medical insurance premiums.

If you’re not sure what you can claim, it’s best to keep your receipts and then work with your tax advisor to determine what’s useful.

What’s new for the 2022 tax season

Every tax season brings new and exciting developments to consider. Certified Professional Accountants (CPA) are experts whose responsibility it is, in part, to stay abreast of these changes.

It’s empowering to be aware of them as it helps to know which questions to ask when you meet with your CPA.

Here’s what new for the 2022 personal tax season:

- Zero-emission vehicles: the definition of a zero-emission vehicle has changed for vehicles purchased after March 1, 2020.

- Climate-Action Incentive (CAI): The way the CAI is claimed and how payments are given out will change this year.

- Finally!—electronic NOAs. No longer do you have a wait for a paper copy in the mail. Now you’ll receive an email notification about your NOA and be able to download an electronic copy after logging into My Account.

Visit the CRA website for more information on 2022 changes and speak with your tax advisor.

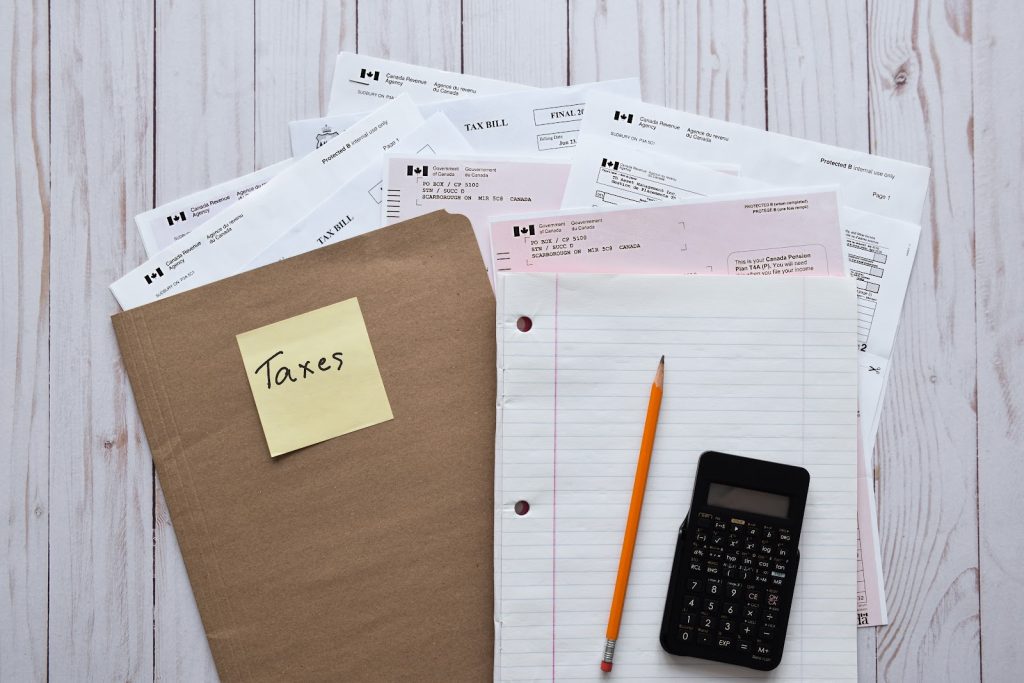

Tips for filling your taxes

What’s the best way to make tax season easier? We can sum it up in four words:

- Organised – Store your receipts and related paperwork in a way that keeps it organised and all together.

- Secure – Keep digital backups of your receipts and paperwork

- Handy – Have your paperwork accessible in case you need it quickly, and to save you time when you want to hand it over to your accountant

- Punctuale – file before the deadline, but not too early. You want to ensure you have received all your needed tax slips before filing to avoid having to file a second time

Finally, don’t worry if a mistake has been made on your tax return. You can always fix the mistake and file again. It’s much worse to file perfectly, but late.

How to secure your finances during tax season

One of the simplest tips to keeping your personal tax information secure is to never open emails claiming they’re from the CRA unless they’re simply asking you to log into your My Account.

An email from the CRA will never include numbers and tax figures. Instead, they’re messages that are:

- Bilingual (english/French),

- Notices saying you have new mail from the CRA for a particular account that may require your attention, and

- Notices to log into your My Account/My Business Account to “View mail”.

If you receive any other email claiming its from the CRA but it doesn’t look or sound like the above, don’t open it. This is especially important if it’s asking you to provide personal information!

Financial support for filing your taxes

If you need help filing your taxes for free, there are programs available to Canadians to help them do exactly that.

The CRA hosts free tax clinics where volunteers help lower-income individuals and families, and those with disabilities, to file their taxes.

How to get support with tax filing in 2022

We hope our ultimate guide to tax filing has helped you feel more confident, empowered, and knowledgeable when it comes to tax season.

Our Certified Financial Planners and Financial Advisors would be happy to advise you about financial planning, income tax, business taxes, RRSPs, TFSAs, and other ways to make tax season work better for you and your family.

Plan year-round for tax season—and enjoy it when it arrives—with the help of BP Group Solutions team.